RiskAMP is a full-featured Monte Carlo Simulation Engine for Microsoft Excel®.

With the RiskAMP Add-in, you can add Risk Analysis to your spreadsheet models quickly, easily, and for a fraction of the price of competing packages.

- The PERT distribution for cost and project modeling

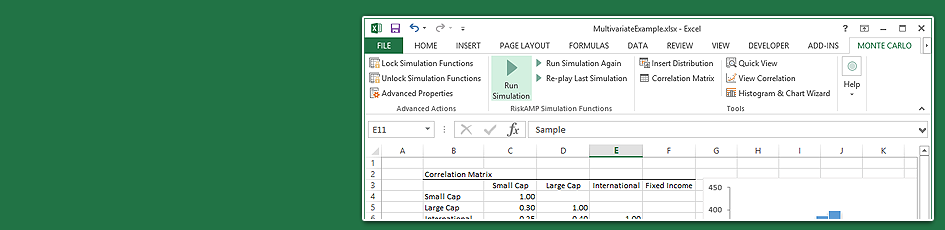

- An easy-to-use wizard for creating tables and charts

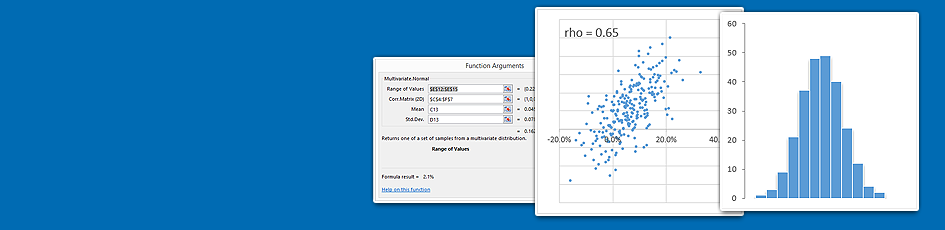

- More than 40 random distributions, including correlated multivariate distributions

- 20 statistical analysis functions

- Latin Hypercube sampling

- Comprehensive VBA integration

- Automatic, embeddable histogram and correlation charts

- Distribution fitting

- Full support for 32-bit and 64-bit Excel 2010, 2013, 2016 and 2019

Try our new browser-based risk platform, RiskAMP web

conditional risk model from our sample spreadsheets

What is Monte Carlo Simulation?

When you build a model of something in the real world — a stock portfolio, a project plan, a clinical trial — you have to build in assumptions about the future. You pick some values for your expected stock returns, for example, and project them into the future.

But the real world doesn't work that way. Stocks go up, and they go down. Projects run over time or under budget.

Monte Carlo simulation is a way to build this variability into your models. Instead of saying this stock will return X% every year, you can say things like this stock will return between X% and Y%; and then figure out what that means to your portfolio.

Once you have that variability in your model, you can start to understand the risk in your model.

What is the likelihood that you will lose money?

What is the probability that the project will run more than a year late?

How Does it Work?

There are three key parts to a Monte Carlo simulation. First, as described above, we replace fixed values — things like expected stock prices and project costs — with random variables. We are adding random variability to the model.

Once that's done, we do the second step: we recalculate the model hundreds or thousands of times, each time changing the random values. This is the "simulation" part — we are simulating the real world where values change randomly.

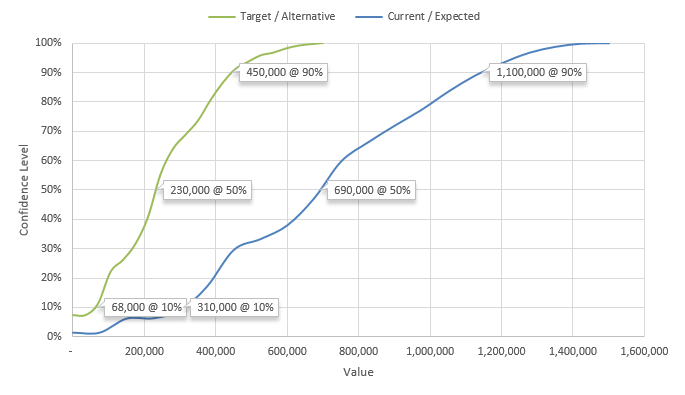

Finally, the third part: we analyze the results of the model by looking at the hundreds or thousands of results, and deriving statistics from those results. For example, we might run a stock portfolio through the simulation process. Then we can look at the results and say in 25% of the cases, the portfolio lost money. Or in 75% of the cases, the portfolio outperformed the market.

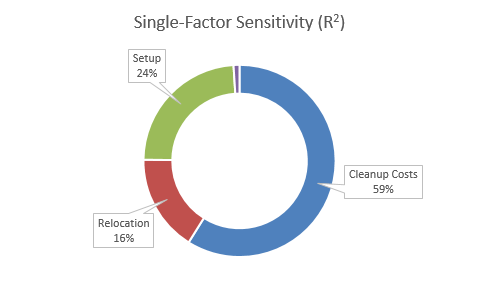

sensitivity analysis using built-in regression functions

Why RiskAMP?

We believe the RiskAMP Monte Carlo Add-In for Excel offers the best combination of features and low price — the best value in Monte Carlo simulation software. But don't take our word for it — we offer a free trial version of the software, as well as an unconditional 30-day money back guarantee.

The RiskAMP Add-in makes it easy to get started, with a complete point-and-click user interface for creating random distributions and generating charts and graphs. Once you get more comfortable with it, you can use the full set of Excel functions to design more complex and more insightful analytical models.

And we are always happy to help you design and implement your spreadsheets to get the most our of your analysis.

Download a Free Trial version of the RiskAMP Add-in

Read more: